Explore web search results related to this domain and discover relevant information.

Black people went from being literally taxed as property to being slighted by the property tax system – perpetuating deep economic inequality for a group of people who have always suffered on the soil of this land.

Though Black Americans are no longer taxed as property, their relationship with the property tax system remains challenging. Today, for instance, Black families pay more property taxes than white Americans who own comparable properties.Black people went from being literally taxed as property to being slighted by the property tax system – perpetuating deep economic inequality for a group of people who have always suffered on the soil of this land.Genuine tax equity is not only possible, but it’s within reach. The civil rights battles of the past 70 years showed how Black leaders and lawmakers can work together to achieve progress in housing, voting, education, jobs, health care, and taxes to redress racial harms.Understanding what led us to this point means acknowledging the brutalization of Black Americans through slavery. This inhumane institution included the taxation of Black people as property. This was no minor issue. Slave taxes were a massive revenue source that paid for public investments that benefited white slaveholders and non-slaveholders alike.

Black Money rule changed: No penalty or prosecution even if you fail to disclose foreign assets in these situations

The Income Tax Department offers relief regarding unintentional black money. Individuals failing to disclose foreign assets up to Rs 20 lakh may avoid penalties and prosecution. This applies to assets excluding immovable property. The Central Board of Direct Taxes amended its instructions.Income Tax GuideIncome Tax Slabs FY 2025-26Income Tax Calculator 2025New Income Tax Bill 2025 In simpler terms it means if someone doesn’t disclose foreign assets (excluding immovable property) valued up to Rs 20 lakh in total, he/she won’t face penalties under Sections 42 and 43, and also won’t be prosecuted under Sections 49 and 50. This internal instruction circular about amended rules for the Black Money law, referenced in this article (F.Check out the information below to learn more about the details about this amendment in rules for Black Money law and who benefits from these amended rules. According to the Income Tax Department internal instruction dated August 18, 2025, here are the details:Also read: Wife gets tax notice for husband’s Rs 6.75 crore Mumbai house purchase; Bombay High Court gives relief to wife · CBDT in its internal instruction said: Subject: Amendment of Instruction issued under Section 84 of the Black Money (Undisclosed Foreign Income and Assets) and Imposition of Tax Act,2015 ("BMA, 2015") read with Section 119 of the Income tax Act,1961 regarding prosecution provisions under BMA, 2015-reg 1.

As Black women's employment has fallen so has the Black homeownership rate. Learn how ‘The Double Tax’ is driving these trends.

According to a study from The Urban Institute, 60% of Black households had a woman as the head of household in 2019, up from 52% in 1990, meaning they pay for more than half of the household's costs, including housing. For white households, 49% had a woman as the head of household in 2019, up from 30% in 1990. The Double Tax How Women of Color Are Overcharged and Underpaid by Anna Gifty Opoku-Agyeman and Chelsea ClintonPenguin Random HouseAccording to Anna Gifty Opoku-Agyeman, author of the new book The Double Tax: How Women of Color Are Overcharged and Underpaid, Black women are more likely than white women to rely on their own income rather than generational wealth to achieve homeownership, which means that the employment status of Black women is more impactful on their households’ homeownership status.According to a new report from Redfin, the Black homeownership rate fell to 43.9% in the second quarter of 2025, down from 45.3% in Q2 of 2024. The decline in Black homeownership coincides with a rise in Black unemployment. The unemployment rate for Black Americans is 7.5%, which is the highest it's been since 2021.More than 200,000 fewer Black women are employed this year than last year: the seasonally adjusted number of employed Black women 20 years and over decreased to 10,260,000 in August from 10,462,000 in August 2024.

It damages the economy, enhances inequality, and promotes corruption. But guess what? Now, the government of India is set to make very important changes by updating income tax laws to fight this problem.Black money means income that is either illegally earned or not revealed to the tax authorities.

Black money is being considered one of the big problems in India. It damages the economy, enhances inequality, and promotes corruption. But guess what? Now, the government of India is set to make very important changes by updating income tax laws to fight this problem.Black money means income that is either illegally earned or not revealed to the tax authorities.Discover What Is Black Money? Meaning, Definition, and Recent Amendments made by the government to tackle illegal wealth and tax fraudBlack money means income that is either illegally earned or not revealed to the tax authorities. While it may seem like a distant issue to many, it actually impacts every citizen in the form of increased prices, reduced public services, and weakening of the economy.In simpler terms, black money is income not fully reported in order to avoid paying taxes. Usually, such incomes originate from illegal activities like corruption, secret deals, and sales on the black market.

As a money coach and a Black woman, I’ve seen the racial wealth disparity firsthand.

Among Black Americans, it’s not uncommon for those who can to help family members financially: Some call it the “Black tax,” a term commonly used in South Africa that refers to the obligations of first-in-the-family college graduates, professionals, or others who “make it” to assist their family members.I’m not alone in experiencing the realities of living with the Black tax. Recently, on the social media app Clubhouse, an entire conversation was devoted to this topic.“It was like a therapy session for Black professionals,” Johnson later told me of the Clubhouse experience. “There’s so much to unpack about the Black tax,” he added, “because it’s definitely a hidden burden that’s in the back of your mind all the time.”I’m definitely not judging her, as I’ve battled the same demons. Twenty years ago, I had $100,000 just in credit card debt. Fortunately, I paid it all off by aggressively budgeting, reining in excess spending, and using every bit of “extra” money — like income tax refunds and work bonuses — to attack my debts.

Black Americans remain the only racial group with a homeownership rate below 50 percent.

Black Americans’ properties have been undervalued by home appraisers and overvalued by tax assessors. That double punch has left Black homeowners more prone to falling behind on their taxes and, ultimately, to dispossession. One such case involved a Black landowner in North Carolina who lost his land in 1920.A book published this week, “The Black Tax,” explains how the case of Floyd’s great-great grandfather was not unusual under a system that crystallized soon after Black Americans began acquiring property.Black Americans owned more than 16 million acres by 1910. On the surface, that looks like a success. What lies beneath that? It was a remarkable achievement in the face of enormous odds. By the turn of the 20th century, though, a clear pattern of over-taxation of Black-owned property was apparent across the South.More deviously, local tax authorities were quick to auction off Black-owned land for unpaid taxes, especially when the land in question had become valuable.

Data shows discrepancies in assessments -- and therefore tax bills -- affect some communities more than others. ABC's analysis found that across the country, homeowners in predominantly Black and Brown areas tend to pay higher taxes than those in mostly white neighborhoods for a house worth ...

Data shows discrepancies in assessments -- and therefore tax bills -- affect some communities more than others. ABC's analysis found that across the country, homeowners in predominantly Black and Brown areas tend to pay higher taxes than those in mostly white neighborhoods for a house worth the same amount on the open market.In Garden City, a predominantly white suburb on New York's Long Island with a median home value of around $1 million, a typical residential tax bill is around $10,000 to $15,000, property data shows. Down the road in Hempstead, where 88% of residents are Black or Latino, homes tend to be worth less than half that.An analysis of real estate data by ABC Owned Television Stations shows that homeowners in majority-nonwhite neighborhoods tend to pay disproportionate property taxes.After more than a decade of making payments toward her $100,000 mortgage, Anderson was diagnosed with cancer in 2020. Amid mounting medical bills and property taxes, the lifelong Baltimore resident says she had to choose between fighting for her life and fighting for her home.

Black tax is a term that originated in South Africa and refers to money that Black workers, especially professionals and other higher income earners give to their parents, siblings, or other family members, often out of obligation or a deeply ingrained sense of family responsibility.

It has been described as Ubuntu (a philosophy that humans must live in sharing relationships with each other), but with an incapacitating twist for the Black professional. A similar socially imposed obligation to care for parents and other family members in Latino culture is called the brown tax.For example, a Black professional may earn a desirable income, but may have expenses that do not appear in the household budgets of people from more individualistic cultures, such as paying for the basic needs of a parent or other family member who is unable to afford healthcare, housing, heat, or other essentials. In other cases, the Black tax can take the form of an individual letting a family member or someone from their hometown live with them at no charge, which raises the cost of housing and food for that individual.These expenses mean that a Black professional with poorer relatives or with greater amounts of debt is unable to save as much money as another person at a similar income level who does not have the same familial financial pressures. In some cases, if the "taxed" person does not meet expectations, family members who feel neglected may lose trust in them, or it may cause a loss of social status for their family.UK-based Zimbabwean author Masimba Musodza's short story entitled Black Tax explores the phenomenon in the context of Zimbabweans living in the United Kingdom and other wealthy nations who support relatives back home.

An economic justice advocate on the "double tax" consequences of cutting off SEPTA — a lifeline for Black Philadelphians who use it most

The recent funding cuts to SEPTA by Pennsylvania lawmakers, combined with fare increases, disproportionately harm Black Philadelphians, who make up over half of SEPTA’s ridership. This situation represents a “double tax” — first through taxes already paid, and again through diminished service, longer commutes, and added costs.False stereotypes about Black dependency reinforce these inequities. ... Establish dedicated, multi-year state funding formula for transit. Conduct ongoing equity audits of state transportation budgets. Enact progressive federal tax reforms to increase public investment.There’s no debating whether Harrisburg’s severe funding cuts to SEPTA are a racial justice issue. Paired with the incoming fare increases, the Black residents who make up more than half of ridership are now paying twice. First, through the federal, state, and local taxes they pay each year that already support the system.This is what Anne Price and her team at the Maven Collaborative call “quiet violence,” or the unequal tax structures and broader forms of economic extraction that disproportionately siphon resources from Black people and Black women, in particular.

As black Americans are leading protests against police violence in the United States, a new study shows they pay a disproportionate amount of the property taxes that help fund local police.

Black-owned homes are consistently assessed at higher values, relative to their actual sale price, than white homes, according to a new working paper by economists Troup Howard of the University of Utah and Carlos Avenancio-León of Indiana University. African Americans have long said they bear a disproportionate burden for taxes that support local police, schools and parks, but nationwide measures of this type of systemic racism are hard to come by.In almost every state, property tax assessments were higher in areas with more black and Hispanic residents. In city after city, the authors show it is not just differences in the buildings or land but also the racial composition of the neighborhood that matters.The gap between white families and minority households remains large — 10 percent — when you combine data for Hispanic and black families. (The authors excluded California because Proposition 13, passed in 1978, drastically changed how property is valued there.) The findings did not surprise Charles, a Chicago-area general contractor in his mid-60s. ... “We’ve always considered that in addition to paying your regular tax, there was a black tax that goes along with it,” said Charles, who spoke on the condition that his last name not be used, citing elevated personal and professional risks faced by black men right now.Dorothy Brown, an Emory University law professor who researches systemic racism in tax policy and was not involved in this study, sees the same pervasive effect. “The structure of the property tax system operates to disadvantage black Americans,” she said.

In Black business hubs such as Atlanta and Chicago, Black entrepreneurs have had to freeze hiring, lay off staff, raise prices, and/or consider going out of business altogether. Tariffs, a tax on imported goods, raise the price of doing business for entrepreneurs who need commodities from foreign ...

In Black business hubs such as Atlanta and Chicago, Black entrepreneurs have had to freeze hiring, lay off staff, raise prices, and/or consider going out of business altogether. Tariffs, a tax on imported goods, raise the price of doing business for entrepreneurs who need commodities from foreign countries.The Power of the Black Community: How Brands Can Tap Into $1.4 Trillion in Buying Power ... As defined in their own literature, “buying power is the total personal income of residents that is available, after taxes, for spending on virtually everything that they buy…” This does not account for the money that people borrow or the debt they accrue.Black capitalism rests upon two primary myths: the circulating Black dollar and Black buying power. For purposes of this essay, in honor of National Black Business Month, we will use tariffs and trade to highlight the contradictions and limitations of each myth while decoupling the legitimate sentiments that may drive us to support them.Sadly, Trump’s tariffs serve as another reminder that Black capitalism exists in the same globalized economy as everyone else. Black entrepreneurs wrestle with supply, distribution, currency fluctuation, interest rates, loans, staff wages, etc., like all other businesses, with the added limitations white supremacy places on their bottom line.

It can be hard to put effort into ... the Black community, but it also resonates with other ethnic groups. It refers to regular payments given to family members, to help support them financially....

It can be hard to put effort into your job, then have a slice of your income go into the pocket of others who rely on you. 'Black Tax' is a term used by members of the Black community, but it also resonates with other ethnic groups. It refers to regular payments given to family members, to help support them financially.The term has its roots in South Africa, due to financial inequalities faced by many households there. But these inequalities also exist in plenty of other countries – and Black Tax tags along. For example, GOV.UK (Opens in new window) lists Black households as one of those with the highest unemployment rate.Nonso (25) likens Black Tax to “filling up financial holes that would otherwise remain open in the family”.Nonso points out that with Black Tax, "you are working but not for yourself alone.

JavaScript is disabled in your browser · Please enable JavaScript to proceed · A required part of this site couldn’t load. This may be due to a browser extension, network issues, or browser settings. Please check your connection, disable any ad blockers, or try using a different browser

Traverse City Man Charged with Tax Charges Related to Black-Market Marijuana Operation

MSP recovered 134 marijuana plants, more than 230 pounds of processed marijuana, over $100,000 in cash, two vehicles, and six Rolex watches worth more than $100,000 from Cunningham’s residence. It is alleged Cunningham received income from this black-market marijuana operation and failed to file taxes between 2021 and 2022./ag/news/press-releases/2025/09/04/traverse-city-man-charged-with-tax-charges-related-to-black-market-marijuana-operationLANSING – Yesterday, John Cunningham, 55, of Traverse City, was arraigned in the 54A District Court in Lansing on two counts of Filing a False or Fraudulent Income Tax Return, each a 5-year felony, announced Michigan Attorney General Dana Nessel.“When Michiganders voted to legalize marijuana, they did so with the expectation that sales would be taxed and the revenue would go toward benefiting our communities,” Nessel said.

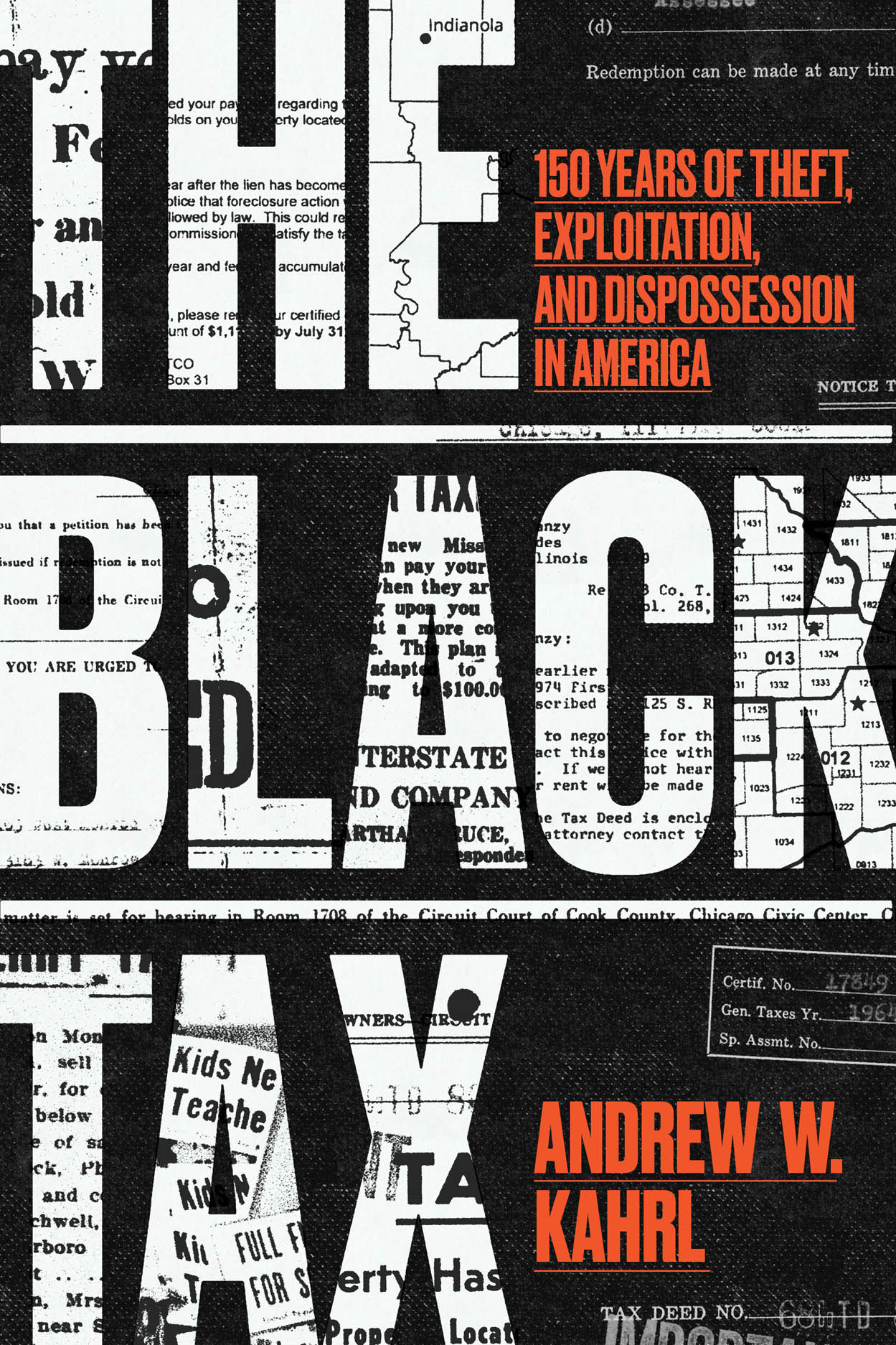

In a new book, historian Andrew W Kahrl looks at the many systemic ways that prejudicial and harmful practices have affected financial stability

Property value assessment may not sound like the most thrilling of topics, but according to historian Andrew W Kahrl’s new book The Black Tax, it represents a hugely important piece of structural inequality in the US, one that implicates a wide range of topics, including the process of gentrification, the quality of public schools and other amenities, and maintenance of local infrastructure.These unequal taxes have had all sorts of downline repercussions, making them a “missing piece” of the puzzle when it comes to inequality in the US. Kahrl traces this story back to America’s post–civil war period – in 1865, a delegation of Black leaders told the victorious general William T Sherman that in order to guarantee their freedom what they needed was land of their own.In the postwar south, tax policy immediately became a tool of social engineering: in some cases, it was being used to force Black people back on to plantations, but it was also used by progressive governments to break up large estates to make way for Black landowners, ultimately “fuel[ing] the sharp increase in Black landholdings during these years”.Kahrl finds that, among others, WEB DuBois in Georgia shed light on the fact that “the property held by the wealthy enjoyed ‘wholesale undervaluation’, while the ‘very small estates of the poor’ were overvalued, with Black-owned land the most overassessed”. Misusing the assessment process to overvalue Black land by as much at 50% – in spite of Black people generally being afforded inferior parcels of land to white people – was one way that power brokers were setting the stage to perpetuate forms of exploitation and segregation against Black residents. As the 20th century marched forward and suburban development began in earnest, the assessment process became a significant factor in white flight. “Because of unfair tax practices against African Americans, whites could actually have lower tax rates generate higher overall tax returns,” Kahrl explained to me.

Revealing a history that is deep, broad, and infuriating, The Black Tax casts a bold light on the racist practices long hidden in the shadows of America’s tax regimes. American taxation is unfair, and it is most unfair to the very people who critically need its support.

The book The Black Tax: 150 Years of Theft, Exploitation, and Dispossession in America, Andrew W. Kahrl is published by University of Chicago Press.Not only do taxpayers with fewer resources—less wealth, power, and land—pay more than the well-off, but they are forced to fight for their rights within an unjust system that undermines any attempts to improve their position or economic standing. In The Black Tax, Andrew W.Of these, Kahrl shows, few were more powerful, or more quietly destructive, than property taxes. He examines all the structural features and hidden traps within America’s tax system that have forced Black Americans to pay more for less and stripped them of their land and investments, and he reveals the staggering cost.Kahrl exposes the painful history of these practices, from Reconstruction up to the present, and tells, for the first time, the story of Black Americans’ experiences as taxpayers and their fight for a more fair and equitable system for raising and spending the public’s money.

Also, it's wild when you realize Harriet Tubman and Ronald Reagan were alive at the same time. That's how close we are to these injustices. The Black Tax is the shadow of barriers built over centuries, stealing not just wealth but also opportunities from our folks.

Also, it's wild when you realize Harriet Tubman and Ronald Reagan were alive at the same time. That's how close we are to these injustices. The Black Tax is the shadow of barriers built over centuries, stealing not just wealth but also opportunities from our folks.So yeah, we've come far as a whole — but the racists haven't (they still dragging their knuckles like the savages they are), which is the cause of us fighting the same old battles. The Black Tax is real and heavy, more than just money—it's about our right to thrive without being dragged down by a history that ain't as fast as some like to think.We need to shake things up.It's about smashing those barriers and crafting a legacy about more than survival—prosperity and breaking free.I hope this generation removes this "black tax burden" through success and changing the system.All descendants of enslaved Africans in the US who look Black or have an African American parent are affected by the Black Tax, even if it's not a day-to-day punch in the gut for some.

Black Americans are about three to five times more likely to be audited by the IRS than other taxpayers, a new study shows. Here's what it means for filers.

The Treasury Department said, "Equitable enforcement of our tax laws is a top priority for the administration" and Inflation Reduction Act funds will help upgrade technology and hire top talent. ... Black Americans are roughly three to five times more likely to face an IRS audit than other taxpayers, according to a new study.Specifically, the study examines audits of filers claiming the earned income tax credit, a tax break for low to moderate earners. The credit is refundable, meaning eligible filers can receive it even with zero taxes due. The findings show Black filers claiming the earned income tax credit were more likely to be audited than non-Black filers claiming the same credit.Black Americans are roughly three to five times more likely to face an IRS audit than other taxpayers, according to a study."It's a type of audit that the IRS does a lot," she said. "It's cheap, it's easy to perform and Black taxpayers get caught up in that disproportionately relative to non-Black taxpayers."

Explore black tax and its impact on building generational wealth. Discover what it means for young professionals and families and structural inequality.

In a nutshell, black tax seeks to address the continued economic imbalances that can be traced back to apartheid, slavery, historical injustices, structural inequality and educational disparities. While others have described it as a form of investment – Ubuntu – it also has an incapacitating element.This is seen in other parts of the world as well. A report by the Institute of Policy Studies revealed that 37% of black families in the US (where black tax is also common) have debts that are equal to or greater than their assets.In contrast with Western societies, the African system encourages black tax, or at least creates the conditions where families have no other choice. The black middle-class is obliged to take care of the poor and the culture of taking care of each other is in the fibre of black communities.The practice of “redlining” certain areas, under which the government does not guarantee loans for black Americans trying to purchase homes, is just one example. Governments in many African countries fail their people by not using their taxes efficiently or appropriately to provide for people’s basic needs.

The Black Tax: The Cost of Being Black in America [Rochester, Shawn D] on Amazon.com. *FREE* shipping on qualifying offers. The Black Tax: The Cost of Being Black in America

Professionals in academia, the media, and the business community, along with people in the general public have struggled to explain the significant and persistent gaps (in wealth, employment, achievement and poverty) between Black and White communities in what they perceive to be a post racial America.In his new book The Black Tax: The Cost of being Black in America, Shawn Rochester shows how The Black Tax (which is the financial cost of conscious and unconscious anti-black discrimination), creates a massive financial burden on Black American households that dramatically reduces their ability to leave a substantial legacy for future generations.Rochester lays out an extraordinarily compelling case which documents the enormous financial cost of current and past anti-black discrimination on African American households. The Black Tax, provides the fact pattern, data and evidence to substantiate what African Americans have long experienced and tried to convey to an unbelieving American public.Backed by an exceptional amount of research, Mr.He then establishes a framework that Black Americans and other concerned parties can use to eliminate this tax and help create the 6 million jobs and 1.4 million businesses that are missing from the Black community.The Black Tax takes the reader through a complete paradigm shift that causes the reader to evaluate all forms of spending and investment in terms of the number of jobs created or businesses developed within the Black community.The Black Tax is immensely informative, thoroughly engaging and makes one of the most compelling and effective cases to commercialize Black businesses since the founding of the Negro Business League in 1910.Shawn has a Bachelor of Science in Chemical Engineering from The University of Rochester and a Master’s degree in Business Administration from The University of Chicago Booth School of Business with a focus in Accounting, Finance and Entrepreneurship. He is the author of The Black Tax: The Cost of Being Black in America and CPR for the SOuL: How to Give Yourself a 20% Raise, Eliminate Your Debt and Leave an Inheritance for Your Children’s Children.